• Deforestation concerns as more consumers return to charcoal

• FG insists five million cylinders to be distributed by 2030

• Local production hits 80% as marketers blame affordability, funding

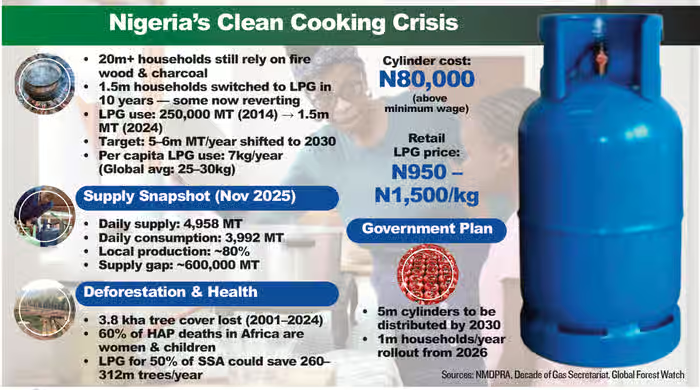

Over 20 million Nigerian households continue to rely on firewood and charcoal for cooking despite a decade of policy push, rising domestic LPG production and over $500 million in private investment, as affordability constraints and weak last-mile distribution stall the country’s clean cooking transition.

Although more than 1.5 million households have switched from kerosene and biomass to liquefied petroleum gas (LPG)in the past 10 years, some consumers yesterday told The Guardian that they have returned to charcoal amidst worsening deforestation and extreme weather in Nigeria.

Industry players also insisted that progress remains far too slow for a country with one of the world’s largest gas endowments. While LPG consumption has risen from about 250,000 metric tonnes in 2014 to roughly 1.5 million tonnes in 2024, the federal government’s long-standing target of between five and six million tonnes per year remained a mirage and has now been moved to 2030.

Per capita consumption stands at about seven kilogrammes yearly, compared with a global average of between 25 and 30 kilogrammes, underscoring the depth of Nigeria’s clean cooking gap.

Marketers estimate that at least 20 million households remain dependent on firewood and charcoal, particularly in rural and peri-urban areas, where poverty, poor infrastructure and limited retail presence make LPG inaccessible.

The federal government, however, insisted yesterday that it is committed to reversing the trend. Under the National Gas Expansion Programme and the Decade of Gas initiative, authorities plan to distribute millions of free LPG cylinders to vulnerable households and scale up domestic usage.

The Coordinating Director of the Decade of Gas Secretariat, Ed Ubong, told The Guardian that ceremonial kick-offs of the cylinder distribution scheme have been completed across the six geopolitical zones, including Abuja, Ikeja, Uyo, Maiduguri, Sokoto and Owerri, with the South-East launch concluded in December 2025.

According to Ubong, the state-by-state rollout targeting one million households per year is expected to begin in 2026, with an overall target of five million homes by 2030.

However, marketers and energy experts say the programme risks being stalled like previous interventions, unless affordability is addressed head-on. This comes as Global Forest Watch disclosed that between 2001 and 2024, Nigeria lost 3.8 kha of tree cover, as there were 1,603 deforestation alerts reported in the country between 22nd of December 2025 and 29th of December 2025, covering a total of 20 hectares.

As of November 2025, the Nigerian Midstream Downstream Petroleum Regulatory Authority, in a fact sheet, showed an average daily LPG supply of 4,958 metric tonnes against daily consumption of 3,992 tonnes, with retail prices ranging from N950 to as high as N1,500 per kilogramme.

For a standard 12.5kg cylinder, households now pay between N12,500 and N15,000 for refills, while the cost of acquiring a cylinder has risen sharply and averaging at about N80,000, a figure higher than the minimum wage.

Managing Director of Selai Gas, Damilola Owolabi-Osinusi, described cylinder acquisition as the single biggest barrier to adoption.

“You cannot use LPG without a cylinder, yet a standard 12.5kg steel cylinder now sells for about N80,000. That is beyond the reach of millions of low-income households,” she said.

To manufacture cylinders locally, Owolabi-Osinusi said exchange rate volatility, power costs and imported raw materials continue to drive up prices, even for domestic producers.

She cautioned against premature discussions around composite cylinders, which are significantly more expensive. On pricing, she acknowledged that LPG prices have eased slightly in recent months but remain unaffordable for the poor.

“When households compare gas with firewood or charcoal, gas loses out. Their priority is to cook and eat, not the long-term health implications of smoke inhalation,” she said, calling for government support to local manufacturers through tax waivers, stable power supply and targeted subsidies.

She argued that once a household owns a cylinder, sustained gas use becomes more likely. “Without that first step, without the equipment, there can be no transition to clean cooking,” she said, adding that supply shortages often force households that have already switched back to biomass fuels. In Bayelsa State, trader Ebi Wonodi said rising gas prices compelled her to return to charcoal, despite the health risks.

“Gas is too expensive now. I don’t have a choice,” she said, standing by a roadside firewood stove in Yenagoa. Her experience reflects a wider pattern, as Nigerians revert to biomass even amid rising extreme heat and stroke cases linked to household air pollution.

As costs rise, households such as Ugochukwu Amarachi’s in Dawaki, Abuja, and millions like hers are returning to forests for survival.

She disclosed that the cost of refills became unbearable for her household since a kilogramme moved from about N700 to N1,500. Chief Executive of the Chamber of Oil Marketing Companies in Ghana and Africa Regional Director of the Society of Petroleum Engineers, Dr Riverson Oppong, said household air pollution from firewood is responsible for about a quarter of global deaths from stroke and other chronic diseases.

“Women and children face the highest risk, particularly in rural areas with limited access to clean fuels,” he said. According to Oppong, women and children account for about 60 per cent of premature deaths associated with inhaling household air pollution in Africa.

He added that providing LPG access to just half of sub-Saharan Africa’s population could save between 260 million and 312 million trees annually, equivalent to about 400,000 hectares of forestland.

Nigeria’s reliance on biomass fuels continues to drive deforestation, while undercutting climate commitments made under its Nationally Determined Contributions. Yet, despite having over 209 trillion cubic feet of proven gas reserves, LPG is still treated as a luxury by many households.

Managing Director of Rainoil Gas Limited, Emmanuel Omuojine, said the industry has made significant investments over the past decade, but structural bottlenecks persist. He disclosed that Rainoil’s LPG operations currently include four marine vessels, 10 active storage depots, about 1,000 trucks and more than 2,000 retail outlets nationwide.

According to Omuojine, increased domestic supply has helped cut LPG imports by over 50 per cent, while small and medium-sized enterprises, agro-processors and autogas adoption are driving new demand. He said Nigeria is increasingly positioned to emerge as West Africa’s LPG export hub, with opportunities for job creation across logistics, retail and manufacturing.

However, he acknowledged that a supply gap of at least 600,000 tonnes remains, and that poor roads, ageing truck fleets and inadequate rural retail infrastructure continue to constrain last-mile delivery.

“Filling plants, skids and tanker trucks are required to improve access in underserved communities. Investments in cylinder production, micro-distribution centres and retail support technology are also critical,” he said.

Industry players say collaboration is increasing, with mergers, acquisitions and joint ventures driving new investments in plants, pipelines and processing facilities. Yet, they warn that market penetration will remain limited without sustained consumer sensitisation on safety, health and environmental benefits, alongside stricter enforcement of standards for transportation, plant operations and cylinder handling.

Nigeria is estimated to have more than four million LPG cylinders in circulation, nearly 1.8 million of which have exceeded their recommended lifespan of 10 to 15 years. Ageing cylinders increase the risk of leaks and explosions, a danger underscored by a deadly blast in Sagamu, Ogun State, in July that killed more than 16 people.

The President of the Nigerian Association of Liquefied Petroleum Gas Marketers, Oladapo Olatunbosun, said high prices remain the biggest barrier to expanding consumption. While local production has risen to about 80 per cent, boosted by new entrants such as Dangote and Seplat, he said current usage is far below national targets.

“The problem is not awareness but affordability,” he said, calling for targeted subsidies similar to those used in India, Morocco and Niger. Partner at Kreston Pedabo, Olufemi Idowu, said Nigeria’s eroded purchasing power means most low-income households rarely feel the benefits of market-driven reforms.

He described the government’s plan to distribute one million cylinders yearly as a potential game changer but stressed that it must be part of a broader strategy that includes subsidies, micro-distribution networks, safety enforcement and sustained public education.

Executive Secretary of the Major Energy Marketers Association of Nigeria, Clement Isong, said supply consistency and better communication are crucial.

He suggested distributing cylinders and accessories to cooperatives and underserved groups at subsidised rates, while ensuring volumes increase to reduce price volatility.

Former President of the Chartered Institute of Bankers of Nigeria, Professor Segun Ajibola, warned that cooking gas has become increasingly elitist.

“The majority are being forced back to firewood, charcoal and kerosene, with devastating environmental and health consequences,” he said, urging stricter controls on expired cylinders and stronger penalties for environmental degradation.

“The problem is not awareness but affordability,” he said, calling for targeted subsidies similar to those used in India, Morocco and Niger. Partner at Kreston Pedabo, Olufemi Idowu, said Nigeria’s eroded purchasing power means most low-income households rarely feel the benefits of market-driven reforms.

He described the government’s plan to distribute one million cylinders yearly as a potential game changer but stressed that it must be part of a broader strategy that includes subsidies, micro-distribution networks, safety enforcement and sustained public education.

Executive Secretary of the Major Energy Marketers Association of Nigeria, Clement Isong, said supply consistency and better communication are crucial.

He suggested distributing cylinders and accessories to cooperatives and underserved groups at subsidised rates, while ensuring volumes increase to reduce price volatility.

Former President of the Chartered Institute of Bankers of Nigeria, Professor Segun Ajibola, warned that cooking gas has become increasingly elitist.

“The majority are being forced back to firewood, charcoal and kerosene, with devastating environmental and health consequences,” he said, urging stricter controls on expired cylinders and stronger penalties for environmental degradation.

SOURCE: THE GUARDIAN NEWS PAPER