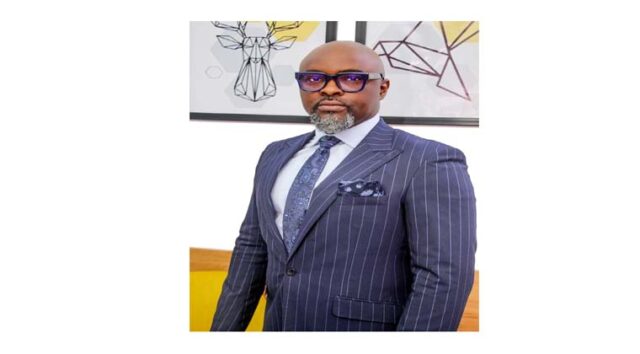

In this interview, Mr. Seyi Asagun, a finance expert with over three decades of experience, speaks on microfinancing and business challenges in Nigeria’s finance sector.

Who is Seyi Asagun, and what shaped your journey into finance and entrepreneurship?

I have a typical humble beginning story. I was born and raised in Kaduna. I attended Kaduna Polytechnic, where I studied Maths and Statistics. I also earned a diploma in Marketing from the Nigerian Institute of Marketing of Nigeria. I moved to Ife in Osun State, where I attended Obafemi Awolowo University and graduated with a degree in Economics. I earned my MBA from Business School Netherlands (BSN). I did my NYSC with Oceanic Bank (now EcoBank), and I was fortunate to be retained, which marked the beginning of my journey into the finance industry. I spent 11 productive years there. At a time when many were avoiding marketing, I knew I wanted to do more with my life than just attend to customers. Eventually, I moved to personal banking, and that shaped the beginning of everything I do now.

Tell us briefly how you ventured into entrepreneurship?

While I was still at Oceanic Bank, I had the opportunity to start a PET bottle manufacturing company. After three years, I realized that manufacturing wasn’t for me, but I was passionate about entrepreneurship and knew that I wouldn’t be in banking forever. So, in 2013, I took the bold leap and started micro-lending, which birthed Entourage Integrated Trust. The establishment aimed to bridge financial gaps for MSMEs and create a platform that would make accessing funds easier for these small businesses. I have over two decades of experience in commercial banking and micro-lending.

Why did the PET bottle manufacturing business not work for you?

Yes, we set up the PET bottle manufacturing plant and began operations, but it didn’t go as planned. We had issues with electricity. The machines required three-phase power, but we often had only one phase. As a result, we ended up running on generators, which consumed diesel all day long and affected our profitability.

While I was still at Oceanic Bank, I had the opportunity to start a PET bottle manufacturing company. After three years, I realized that manufacturing wasn’t for me, but I was passionate about entrepreneurship and knew that I wouldn’t be in banking forever. So, in 2013, I took the bold leap and started micro-lending, which birthed Entourage Integrated Trust. The establishment aimed to bridge financial gaps for MSMEs and create a platform that would make accessing funds easier for these small businesses. I have over two decades of experience in commercial banking and micro-lending.

But why entrepreneurship?

*But why entrepreneurship?*

It was because I saw opportunities in microcredit. While I was at Oceanic Bank, we got a lot of customers to bank with oceanic bank, but when these customers, many of whom were entrepreneurs, needed funding, there were always issues—either they weren’t qualified or lacked the systems to access such funding. The banks weren’t willing to take unnecessary risks. I saw an opportunity in that, which is why I ventured into finance.

What are some of your experiences and understanding of the Nigerian business landscape?

Growing up in a poor neighborhood, I experienced what we typically call poverty. But I realized that to achieve the economic empowerment I desired, I needed to focus on entrepreneurship. The people who were comfortable back then were those involved in business. The question was, what do I want to do? What opportunities are available to me? my immediate community was not going to offer the economic prospects I wanted at the time. There was a “Lagos dream” — everyone wanted to achieve that Nigerian dream, and I thought Lagos would be my gateway. So, I moved to Lagos, which I consider a land of opportunities. The Nigerian economy is still rapidly growing, offering various opportunities. As an entrepreneur, you need to stay grounded and be proactive. Opportunities come up all the time; you just need to be prepared. I’ve always seen opportunities and taken them because I was ready for them. Nigeria is a land flowing with milk and honey, and everyone should aim to capitalize on the opportunities the nation presents.

As the CEO of Entourage Integrated Trust, how will your firm help small businesses grow?

Many of these small businesses have integrity, and we work with them on a daily basis, but the banks won’t just give funds based solely on trust. Since we interact with these businesses on a personal level, we know the kind of people they are. I decided to move away from commercial banking, start my own MFI (Microfinance Institution), and bridge the gap by providing SMEs access to funds. There are many people who want to do business but don’t have capital, and many businesses that want to grow but lack funding. Entourage was created to solve capital issues and provide funds for SMEs. We took it a step further by offering loans to the unbanked — those who don’t have access to any form of funding.

Tell us about your concept of ‘smarter finance’ for small businesses.

When you talk about smarter finance, I believe it’s about education, specifically financial literacy. It’s more than just giving out money; we also need to educate business owners on how to apply the funds they receive. When we give you money, it’s for a specific purpose, and it’s important that it’s used for that purpose. We’ve seen cases where people take loans and use them for personal expenses like marrying another wife or paying children’s school fees. The concept of smarter finance is not just financing customers, but also educating them on how to manage their finances properly.

Why do many small businesses struggle to access funds from commercial banks?

Commercial banks avoid risks as much as possible, and you can’t blame them. There are regulatory bottlenecks and other factors, such as policies from the CBN, that they must comply with. The other side of the problem is the businesses themselves. Many businesses aren’t organized enough to position themselves to take advantage of available funding. So, what we try to do is enlighten our customers on how to structure their businesses properly, especially in terms of keeping proper accounts. A lot of small businesses are run as sole proprietorships, where the owner cannot differentiate his personal account from the business account. That’s a major issue that most SMEs face in Nigeria when it comes to funding.

How can small and nano businesses separate their business from the “MMF (make money and feed)” system?

Education is key — whether formal or informal. You don’t have to go to university, but you need to be educated enough to understand your business and the systems that are necessary to build it. You must develop core competencies. Many people go into business without understanding what they’re doing. For instance, before I started the PET bottle business, I spent a year researching. The same goes for starting the MFI — there was a lot of research involved, and we knew the core skills required. Education is the starting point — whether formal or informal. You don’t need a university degree, but you must be educated enough to understand your business, its systems, and how to grow sustainably. One of the biggest mistakes small business owners make is jumping into business without knowing what they’re doing. You must develop core competencies — especially in areas like finance, operations, and customer relationships. Most importantly, learn how to manage your finances. Be disciplined enough to separate your business funds from your personal money. That’s where real growth begins.

What are some of the misconceptions about microfinance that you would like to correct?

I think the major misconception about microfinance is that many people view us as loan sharks. A loan shark is a system where wealthy individuals take advantage of the less privileged, offering loans at very high interest rates. Many believe microfinance companies are loan sharks, but this is a great misconception. We are not loan sharks. That’s why we emphasize that our loans are designed to make life easier for our customers. We are not asking for payment upfront along with the interest. While loan sharks impose enormous interest rates, microfinance focuses on helping your business and providing funding with minimal interest.

So, tell us about your services.

In terms of lending, we offer daily, weekly loans, as well as a digital lending platform. But above all, we also provide a lot of financial counseling because financial inclusion is very important to us. We need to ensure that people know what they’re doing with their funds. We offer a lot of advisory services, and our website — www.entourageloans.com — contains all our contact details.

Amlodipine HeartMedsEasyBuy buy blood pressure meds