To bolster Nigeria’s move to meet two million barrels per day (mbpd) oil production by year end, the minister of state, Petroleum Resources (Oil), Heineken Lokpobiri has has charged Oando PLC boost its output to 100,000bpd following its recent acquisition of the Nigerian Agip Oil Company (NAOC) onshore assets.

The acquisition, valued at $783 million, has significantly expanded Oando’s footprint in Nigeria’s oil and gas sector. The deal, which was finalised in August 2024, saw Oando acquire 100 per cent of NAOC’s shareholding interest from Italian energy company Eni.

The transaction has increased Oando’s participating interests in Oil Mining Leases (OMLs) 60, 61, 62, and 63 from 20 per cent to 40 per cent, and its total reserves have jumped from 505.6 million barrels of oil equivalent (MMboe) to over 1 billion barrels, representing a 98 per cent increase based on 2022 reserve estimates.

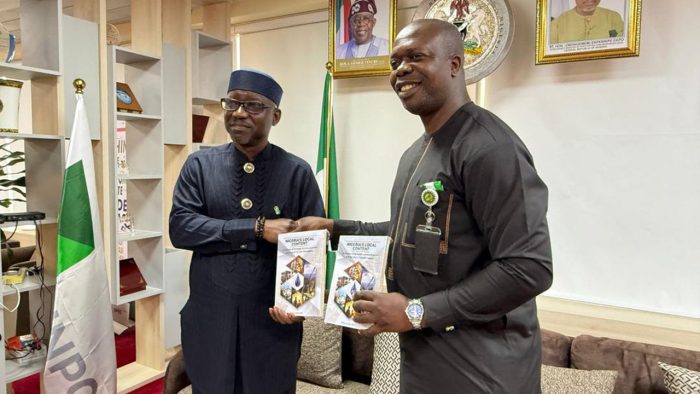

Speaking when the management team of Oando led by the company’s chief operating officer, Ainojie Alex Irune, paid him a visit in Abuja, the minister said there were reports that the firm had already raised its production from over 20,000 b/d to over 30,000 b/d just a few days after the acquisition.

He said: “I am happy to also tell you that I got the information, I got my Intel that following the successful acquisition, and you have already increased production. That is what I am saying that Oando can do. And I am looking forward to the time that you do 100,000.”

He said his job is to do all in his power to create the best environment for Oando and other companies operating in the Niger Delta region to boost production.

He said to lift the country out of its economic challenges, it requires increased crude oil production.

He reiterated that the target of the country is to hit the target of 2 mb/d in December this year.

Lokpobiri said the government is determined to hit the two million barrels per day of oil production by the end of the year.

The expressed delight that the transaction has been successfully completed as it was one of the major issues he inherited when he resumed office about a year ago.

He noted that the government was also determined to create Nigerian international companies that would compete across the world.

“I know that Oando has enormous capacity in such a way that, if given the desired support, we can grow our production in a manner that would be a game changer in this country. I have always contended that the future of our oil and gas in this country lies with the members of the IPPG.

“I have always been asked at international forums whether the indigenous companies have the capacity to sustain the running of these companies. And I told them that our companies have the capacity to run them, professionally and profitably, in such a manner that the federal government will lose nothing.

He pointed out that it was his responsibility to continue to create the best environment in the oil and gas industry for companies to operate in Nigeria.

“My expectation is that Oando will ramp up production in these assets. If you are able to ramp up production it will help to meet the two million barrels production by the end of the year. There are enormous opportunities in the industry and we boldly tell the world that Nigeria is ready for business”, he added.

The minister also disclosed that with the acquisition of NAOC, the stock of Oando Energy PLC has soared. He said his expectation is for the value to increase to N1,000 per share in the stock market.

To provide the right environment, the minister revealed he has already met the Bayelsa State Governor, Douye Diri to solicit cooperation with Oando operations.

He urged the company to take advantage of being an indigenous to relate better with its host community than the International Oil Companies (IOCs) and also hit optimal performance.

He recalled he had granted a media interview informing the foreign press that the indigenous firm could operate the divested assets.

Lokpobri thus, charged the firm to sustain the same momentum the IOCs reached. He congratulated the firm for the history of the acquisition of two firms: Conocophillips and the NAOC.

Meanwhile, Irune said that based on the history of the country that rose from 500 filling stations, it would continue to do great things.

He said with the completion of the acquisition, the company now holds 40 per cent joint venture interest with the Nigerian National Petroleum Company Limited (NNPC).

According to him, it is not only a foreign company that has the exclusivity of being IOCs. He insisted that a Nigerian firm can also do it.

His words: “First transaction was in 2014; ConocoPhillips, 20 cent interest in the JV, and now the conclusion of ENI’s 20 per cent stake now of JV, making us 40 per cent holders in the JV, with the NNPC holding 60 per cent.

“In everything we have done, Minister, we have sought to put the best of local content forward, inspire Nigerians to show that Nigerians can do it. IOC is not a concept reserved only for companies from the West, the Far East, and the like.”

SOURCE: LEADERSHIP